Nvidia, the top AI chip manufacturer worldwide, has once more disrupted the global financial markets — this time with its most recent quarterly earnings report that surpassed even the most hopeful predictions. The firm’s outstanding performance has not only boosted its stock value but also created waves throughout the semiconductor industry, igniting a worldwide chip surge. From Wall Street to exchanges in Asia and Europe, semiconductor companies experienced substantial increases in market value after Nvidia’s announcement.

Nvidia’s Performance at a Snapshot

During its latest quarterly earnings call, Nvidia announced a record revenue of $26 billion, primarily fueled by a significant increase in demand for its AI and data center chips. This represents a significant rise compared to the same quarter of the previous year, highlighting the rapid expansion of AI technologies and the company’s leading position in that environment.

Earnings per share (EPS) also jumped, significantly exceeding analysts’ predictions. Significantly, Nvidia revealed a 10-for-1 stock split and raised its dividend by 150%, demonstrating robust future confidence and striving to enhance share accessibility for retail investors.

Effect on Worldwide Markets

As soon as Nvidia announced its earnings, technology-focused indices such as the NASDAQ and S&P 500 responded favorably, with the NASDAQ reaching record highs. However, the rally extended beyond U.S. borders. In Asia, gains were observed at Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics, and SK Hynix. European semiconductor leaders such as ASML Holding and Infineon Technologies also experienced an optimistic surge.

This worldwide surge highlights Nvidia’s role as a fundamental pillar of the semiconductor sector. Being the main provider of high-performance chips utilized in various applications, from AI servers to self-driving cars, any signs of expansion at Nvidia are interpreted by markets as an indicator of overall industry vitality.

AI and the Future of Microchips

What’s driving this rapid expansion? In a single term: AI.

Nvidia’s processors are essential for training and implementing AI models — including language models such as ChatGPT, image generators, and self-driving systems. As AI keeps growing in various sectors — healthcare, finance, education, and defense — the need for high-performance GPUs (graphics processing units) is expected to rise even more.

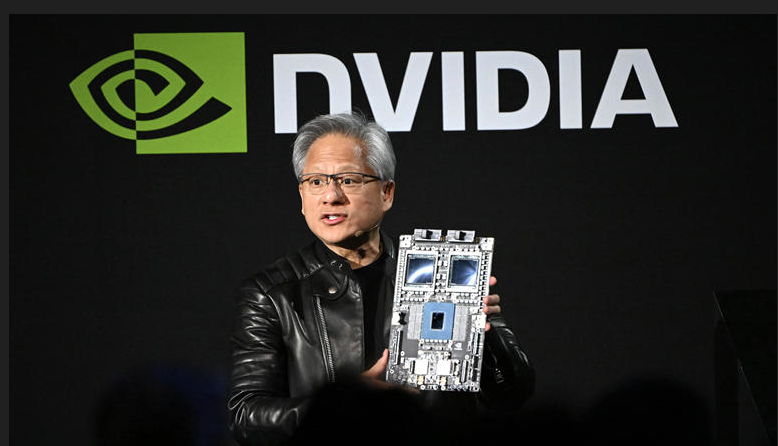

Nvidia’s CEO Jensen Huang remarked in the earnings call, “We stand at the onset of a new industrial revolution.” AI is changing every industry, and Nvidia is central to this change.

Obstacles Persist

Even with a festive atmosphere, not everything is going perfectly. Geopolitical strains are impacting worldwide chip supply chains, particularly between the U.S. and China. Export limitations and trade obstacles remain a threat for firms such as Nvidia and its production associates.

Moreover, rivals like AMD, Intel, and new startups are fervently entering the AI chip market. Although Nvidia currently has a strong advantage, the competition is intensifying.

Reactions from Investors and the Industry

Analysts on Wall Street have predominantly reacted with excitement. Numerous analysts improved Nvidia’s stock rating, with several increasing their price targets. Investors view the stock split as a tactical decision aimed at attracting a new group of retail investors, potentially boosting demand even more.

Executives in the tech sector also expressed their opinions, perceiving Nvidia’s expansion as an indicator of the overall well-being of the AI ecosystem. The company’s achievements are enhancing trust in ongoing investments in cloud computing, machine learning, and edge AI technologies.

Final Thoughts

Nvidia’s remarkable earnings report not only lifted one stock — it rekindled investor faith in the whole semiconductor industry. The worldwide surge in chip demand that ensued is a strong indication that AI and advanced computing are more than mere fads; they are foundational elements of

Summary

Nvidia’s remarkable earnings report not only lifted a single stock — it restored investor confidence across the whole semiconductor industry. The worldwide chip surge that ensued is a definitive indication that AI and advanced computing are not merely fads but fundamental components of the future digital economy. As Nvidia maintains its record-breaking achievements and broadens its reach, the repercussions will be experienced throughout tech industries and global markets for years ahead.

The message is evident: Nvidia isn’t merely managing a company — it’s spearheading a revolution.