Main Features

- Reciprocal Tariff System: The updated policy implements a standard 10% tariff on most imports, in addition to country-specific “reciprocal” tariffs that vary considerably—reaching up to 50% for countries such as Brazil and Canada.

- Pharmaceuticals and Semiconductors: These key industries encounter never-before-seen tariffs, with pharmaceuticals facing charges as high as 200% and semiconductor chips possibly confronting 100% duties—although manufacturers in the U.S. such as Apple might get exemptions.

- Bilateral Agreements and Decreases: Key trading allies including the EU, Japan, South Korea, and the UK have arranged lower tariffs (e.g., 15% baseline) to minimize the impact of the increases.

- India and Russia Oil Policy: New tariffs seek to punish activities not linked to commerce, including India’s purchase of Russian oil. India currently confronts a 25% tariff, rising to 50% aimed at oil-related commerce.

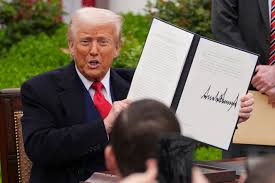

- Objectives and Strategic Goals: Trump has asserted that the tariffs will produce “billions of dollars” in income and enhance domestic manufacturing, portraying them as mechanisms to address unjust trade practices and safeguard national economic interests

Economic Impact Waves

- Effects on Consumers and Companies: American households may face an extra ~$1,300 tax this year, as important industries either transfer expenses to consumers or take on the costs to stay competitive.

- Global Economic Instability: International markets are anxious. Economists, business organizations, and governments have expressed worries about interruptions in global supply chains and possible inflation. Companies such as Toyota have forecasted significant losses as a result of the new tariffs.

- Tariff Revenue Surge: Customs collections have skyrocketed—from $8 billion to $30 billion each month—showing the rapid revenue boost from these measures.

- Legal Issues: The judiciary has started to scrutinize the legal foundation of these tariffs enacted during emergencies. A significant case determined that the executive’s exercise of emergency powers could surpass constitutional limits.

The Conclusion

- Trump’s updated tariff policy is a bold adjustment of trade tactics, prioritizing “reciprocity” and economic realignment. Although it might provide temporary financial benefits and appear robust, the long-term consequences—spanning from increased consumer prices to global backlash—are still unclear. As the worldwide market evolves, the complete consequences of this significant protectionist action are beginning to emerge.

| \\ | Trading partner | New rate | Rate announced in April | Trade balance, 2024 |

|---|

| 1 | Brazil | 50% | 10% | |

|---|---|---|---|---|

| 2 | Syria | 41% | 41% | −$9M−$9M−$9M |

| 3 | Laos | 40% | 48% | −$763M−$763M−$763M |

| 4 | Myanmar | 40% | 44% | −$577M−$577M−$577M |

| 5 | Switzerland | 39% | 31% | −$38B−$38B−$38B |

| 6 | Iraq | 35% | 39% | −$6B−$6B−$6B |

| 7 | Serbia | 35% | 37% | −$604M−$604M−$604M |

| 8 | Algeria | 30% | 30% | −$1B−$1B−$1B |

| 9 | Bosnia and Herzegovina | 30% | 35% | −$126M−$126M−$126M |

| 10 | Libya | 30% | 31% | −$900M−$900M−$900M |

| 11 | South Africa | 30% | 30% | −$9B−$9B−$9B |

| 12 | Brunei | 25% | 24% | −$111M−$111M−$111M |

| 13 | India | 25% | 26% | −$46B−$46B−$46B |

| 14 | Kazakhstan | 25% | 27% | −$1B−$1B−$1B |

| 15 | Moldova | 25% | 31% | −$85M−$85M−$85M |

| 16 | Tunisia | 25% | 28% | −$622M−$622M−$622M |

| 17 | Bangladesh | 20% | 37% | −$6B−$6B−$6B |

| 18 | Sri Lanka | 20% | 44% | −$3B−$3B−$3B |

| 19 | Taiwan | 20% | 32% | −$74B−$74B−$74B |

| 20 | Vietnam | 20% | 46% | −$123B−$123B−$123B |

| 21 | Cambodia | 19% | 49% | −$12B−$12B−$12B |

| 22 | Indonesia | 19% | 32% | −$18B−$18B−$18B |

| 23 | Malaysia | 19% | 24% | −$25B−$25B−$25B |

| 24 | Pakistan | 19% | 29% | −$3B−$3B−$3B |

| 25 | Philippines | 19% | 17% | −$5B−$5B−$5B |

| 26 | Thailand | 19% | 36% | −$45B−$45B−$45B |

| 27 | Nicaragua | 18% | 18% | −$2B−$2B−$2B |

| 28 | Afghanistan | 15% | 10% | −$11M−$11M−$11M |

| 29 | Angola | 15% | 32% | −$1B−$1B−$1B |

| 30 | Bolivia | 15% | 10% | −$73M−$73M−$73M |

| 31 | Botswana | 15% | 37% | −$301M−$301M−$301M |

| 32 | Cameroon | 15% | 11% | −$59M−$59M−$59M |

| 33 | Chad | 15% | 13% | −$25M−$25M−$25M |

| 34 | Costa Rica | 15% | 10% | −$2B−$2B−$2B |

| 35 | Ivory Coast | 15% | 21% | −$424M−$424M−$424M |

| 36 | DR Congo | 15% | 11% | −$96M−$96M−$96M |

| 37 | Ecuador | 15% | 10% | −$974M−$974M−$974M |

| 38 | Equatorial Guinea | 15% | 13% | −$32M−$32M−$32M |

| 39 | EU (on most goods) | 15% | 20% | −$236B−$236B−$236B |

| 40 | Fiji | 15% | 32% | −$163M−$163M−$163M |

| 41 | Ghana | 15% | 10% | −$206M−$206M−$206M |

| 42 | Guyana | 15% | 38% | −$4B−$4B−$4B |

| 43 | Iceland | 15% | 10% | −$82M−$82M−$82M |

| 44 | Israel | 15% | 17% | −$7B−$7B−$7B |

| 45 | Japan | 15% | 24% | −$69B−$69B−$69B |

| 46 | Jordan | 15% | 20% | −$1B−$1B−$1B |

| 47 | Lesotho | 15% | 50% | −$234M−$234M−$234M |

| 48 | Liechtenstein | 15% | 37% | −$177M−$177M−$177M |

| 49 | Madagascar | 15% | 47% | −$679M−$679M−$679M |

| 50 | Malawi | 15% | 17% | −$13M−$13M−$13M |

| 51 | Mauritius | 15% | 40% | −$186M−$186M−$186M |

| 52 | Mozambique | 15% | 16% | −$66M−$66M−$66M |

| 53 | Namibia | 15% | 21% | −$114M−$114M−$114M |

| 54 | Nauru | 15% | 30% | −$1M−$1M−$1M |

| 55 | New Zealand | 15% | 10% | −$1B−$1B−$1B |

| 56 | Nigeria | 15% | 14% | −$1B−$1B−$1B |

| 57 | North Macedonia | 15% | 33% | −$113M−$113M−$113M |

| 58 | Norway | 15% | 15% | −$2B−$2B−$2B |

| 59 | Papua New Guinea | 15% | 10% | −$13M−$13M−$13M |

| 60 | South Korea | 15% | 25% | −$66B−$66B−$66B |

| 61 | Trinidad and Tobago | 15% | 10% | −$422M−$422M−$422M |

| 62 | Turkey | 15% | 10% | −$1B−$1B−$1B |

| 63 | Uganda | 15% | 10% | −$26M−$26M−$26M |

| 64 | Vanuatu | 15% | 22% | −$6M−$6M−$6M |

| 65 | Venezuela | 15% | 15% | −$2B−$2B−$2B |

| 66 | Zambia | 15% | 17% | −$55M−$55M−$55M |

| 67 | Zimbabwe | 15% | 18% | −$24M−$24M−$24M |

| 68 | All other countries | 10% | 10% |