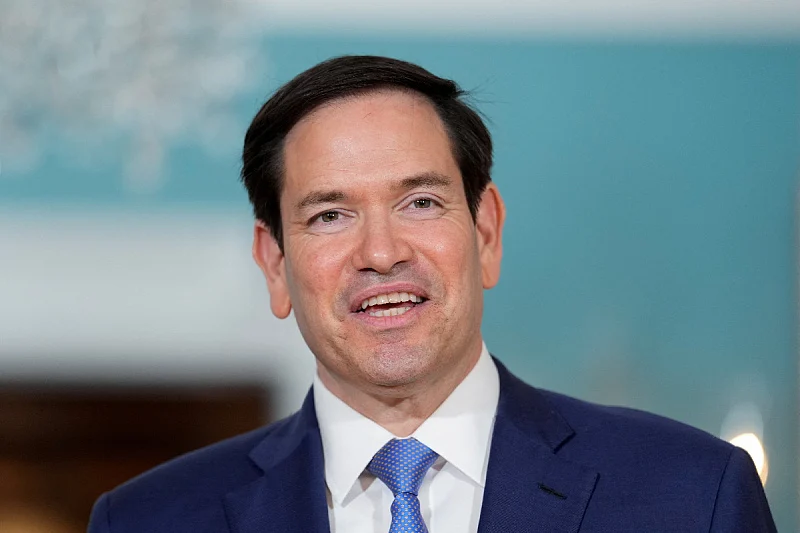

Although regarded as a strategic partner, India’s energy sourcing decisions have faced significant criticism from senior U.S. officials. Please provide the text you would like me to paraphrase. U.S. Annoyance Emerges On August 1, 2025, U.S. Secretary of State Marco Rubio candidly described Secretary of State Marco Rubio openly referred to India’s ongoing acquisition of Russian oil as “definitely a point of annoyance” in the ties between the two countries.

Rubio highlighted that even though India is considered an ally, it is incorrect to presume alignment when New Delhi engages in actions that effectively support Russia’s military efforts. One day prior,

President Trump declared extensive actions such as a 25% tariff on exports from India and unnamed penalties aimed at India’s commercial relations with Russia—particularly regarding oil and defense equipment acquisitions. The administration portrayed this as a means to isolate Russian energy, viewing India’s actions as directly endorsing Moscow’s ongoing military efforts. Sure! Please provide the text you would like me to paraphrase. India’s Energy Equation Since 2022, India has become one of the leading purchasers of Russian crude globally, due to significant discounts and interruptions in Western supply lines. At times, approximately 35–40% of crude oil imports to India came from Moscow—crucial for ensuring local fuel price stability and safeguarding rising trade deficits.

. Indian Oil, Bharat Petroleum, and Hindustan Petroleum, which are state-owned refiners, made up a significant share of these volumes.

Nonetheless, recent changes in the market and a reduction in worldwide discounts led them to halt new Russian acquisitions in early August 2025, even in the absence of clear government instructions

Please provide the text you would like me to paraphrase. Instant Economic Consequences The U.S. influence has echoed worldwide. Oil markets grew tense as futures surged due to tariff threats. Brent crude hovered near $72–73 per barrel, and analysts cautioned about an increasing geopolitical risk premium linked to market instability concerning India’s prospects. Within the country, Indian refiners are assessing the advantages of extremely low-priced Russian crude oil against the significant risks of U.S.penalties, costs for compliance, and sanctions associated with exports.

Transitioning procurement to grades from the Middle East or West Africa introduces logistical challenges, which could lead to increased fuel costs domestically. Sure, please provide the text you’d like me to paraphrase. Geopolitical and Diplomatic Implications U.S. authorities express heightened concern. By focusing on India—the biggest democracy globally and a stronghold against China in South Asia—Washington is evaluating the extent of trade influence over strategic allies. India’s foreign policy tradition of non-alignment and multi-alignment is now experiencing significant stress due to opposing demands: secure affordable energy or forfeit diplomatic support. India remains focused on protecting its national interests.

Officials emphasize that energy choices are influenced by economic factors instead of political affiliations. At the same time, trade talks intended to increase bilateral trade twofold by 2030 are at risk as both parties hold firm on their principles and leverage. Certainly!Kindly provide the text that you would like me to reword

. Potential Policy Directions Moving Forward Various results now appear feasible: Selective moderation and negotiation: India might progressively cut back on its Russian oil imports without entirely severing ties, while pursuing dialogue-focused resolutions with the U.S. Strategic determination: New Delhi could claim energy dominance by continuing trade with Russia, despite potential wider tariff consequences. Worldwide repercussions: Changes might speed up de-dollarization efforts and lead to institutional divides in oil commerce, particularly within BRICS nations. Focus will now shift to metrics including tanker tracking information, purchasing trends of refiners, changes in currency, and diplomatic cues. These will indicate if India opts for strategic compromise or a firm commitment

Conclusion India’s acquisition of Russian oil has emerged as a strong emblem of wider geopolitical conflicts. For Washington, these imports symbolize aid for a nation engaged in conflict in Ukraine; for New Delhi, they indicate a crucial practical decision in an unstable energy market. The confrontation regarding Russian oil goes beyond just quantities; it’s an examination of strategic independence, diplomatic resilience, and the boundaries of alliance dynamics.